alameda county property tax rate

If youre a resident of Alameda County California and you own property your annual property tax bill is probably not your favorite piece of mail. Tax Rate Area Code.

Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others.

. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. The property tax rate in the county is 078. Applicants must file claims annually with the state Franchise Tax Board FTB.

You can also search by state county and ZIP code on. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. Vital records property records tax collection and public health.

Cook County collects on average 138 of a propertys assessed fair market value as property tax. Adjusted Annual Secured Property Tax Bill. In addition it is the local government for all unincorporated areas and provides services such as law enforcement to some incorporated cities under a contract arrangement.

Application for Property Tax Relief for Military Personnel PDF - 10kb. We are accepting in-person online and mail-in property tax payments at this time. A list of property transfers over the past 2 years.

Alameda County property tax. The median annual property tax payment in Santa Clara County is 6650. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

This application form may be completed by the military service person hisher adult dependent or any other individual authorized by the service person to act on hisher behalf. The unpaid taxes are subject only to interest at the rate of six percent 6 per annum. If the change in ownership was a sale the indicated sales price is shown based upon the Clerk-Recorders transfer tax.

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. But remember that your property tax dollars pay for needed services like schools roads libraries and fire departments. The County is committed to the health and well-being of the public.

Santa Clara County property. Alameda County ˌ æ l ə ˈ m iː d ə. Make sure you review your tax card and look at comparable homes.

The average effective property tax rate in Alameda County is 078. Violent crime rate per 1000 persons Property crimes. It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level.

Excluding Los Angeles County holidays. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. For example if the local property tax rate on homes is 15 mills homeowners pay 15 in tax for every 1000 in assessed home value.

Alameda County collects on average 068 of a propertys assessed fair market value as property tax. Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes.

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. Aid is a specified percentage of the tax on the first 34000 of property assessment. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

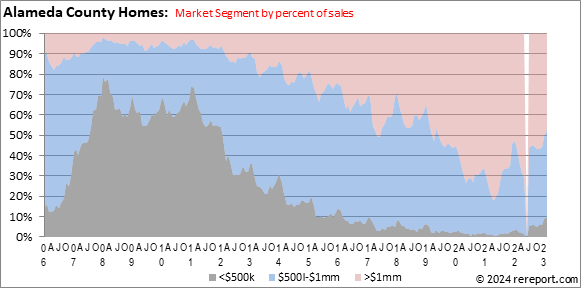

The Alameda County Real Estate Report

Alameda County Ca Property Tax Calculator Smartasset

The Alameda County Real Estate Report

Alameda County Ca Property Tax Calculator Smartasset

The Alameda County Real Estate Report

Berkeley Alameda County Will Join State In Lifting Mask Mandate Feb 16

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Calculator Smartasset

Alameda County California Sales Tax Rate 2022 Avalara

Pin On Articles On Politics Religion

City Of Oakland Check Your Property Tax Special Assessment